A Winning Business

Games Workshop PLC (LSE:GAW) has undoubtedly been a massive British success. I recall many far more sensible investors discussing this absolute superstar on Twitter back in 2016/17, and I quite impressively ignored it all. I probably felt I knew better.

Well, congratulations to me, because Games Workshop’s share price has compounded at nearly 44% a year for the past ten years on a total return basis. This equates to a massive 3,667% growth. To those who had the foresight to see what a wonderful business this is, I salute you. I hope you held, and still hold.

But the question is, would I invest today, given how much growth the share price has experienced? I’m taking a brief look in this article.

A Quality Company

If you’ve read any of my previous posts, you’ll know I generally screen for companies meeting certain metrics. These metrics act as a guideline for growth & performance, stability and quality of management within a business. Ordinarily I’d be looking for the following key figures:

- A return since inception greater than 15% (does the company have the ability to compound returns for investors)

- A 5 year CAGR of 15% or more on net income (has the company demonstrated high and sustained growth in income)

- Levered free cash flow growth of 15% CAGR over the past five years (does the company have the ability to generate and grow free cash for reinvestment into the business, acquisitions or deployment to shareholders)

- A 5 year return on invested capital of greater than 15% (can the company generate good returns on the free cash reinvested into the business)

- A debt to equity ratio of 0.5 or lower (does the company operate consistently with little to no debt)

I’ve kept an eye on Games Workshop for a while now, and they comfortably hit all criteria, which you can read in the table below.

Games Workshop (GAW)

Games Workshop is best known for its Warhammer IP, founded on the design and manufacture of mini figurines and tabletop games for use in strategy gaming. Everything is operated in-house and vertically integrated, ensuring the authenticity by which the brand operates remains paramount. The business has armies of loyal fans, and have in recent years been expanding into the licencing of this increasingly valuable IP in video games, book publishing and the film industry. The business enjoy an almost cult-like following, and it’s hard to really pinpoint a direct competitor to their operation.

Key Figures

| Market Cap: £3,921.28M | P/E: 25.45 | Return Since Inception CAGR: 21.45% |

| Net Profit Margin: 28.74% | ROIC 5Y Avg: 66.72% | Levered FCF Growth 5Y CAGR: 30.75% |

| Net Income 5Y CAGR: 18.09% | Debt / Equity: 0.19 | Dividend Yield: 4.54% |

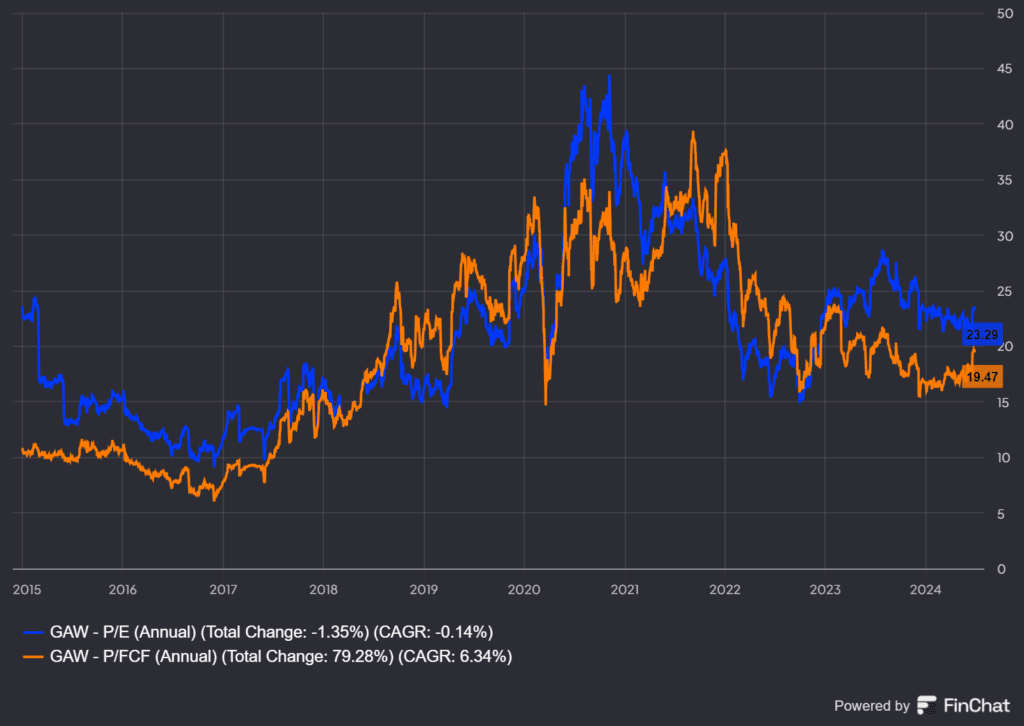

On a simple valuation basis, Games Workshop currently trades at just over 23 times earnings, and under 20 times free cash flow. Whilst neither are egregiously cheap, the business has traded at valuations twice as high in the past few years. The UK equity market as a whole is generally considered at worst fairly valued at the moment, certainly an environment where a P/E of 24 or P/FCF of 20 wouldn’t be considered excessive.

Performance

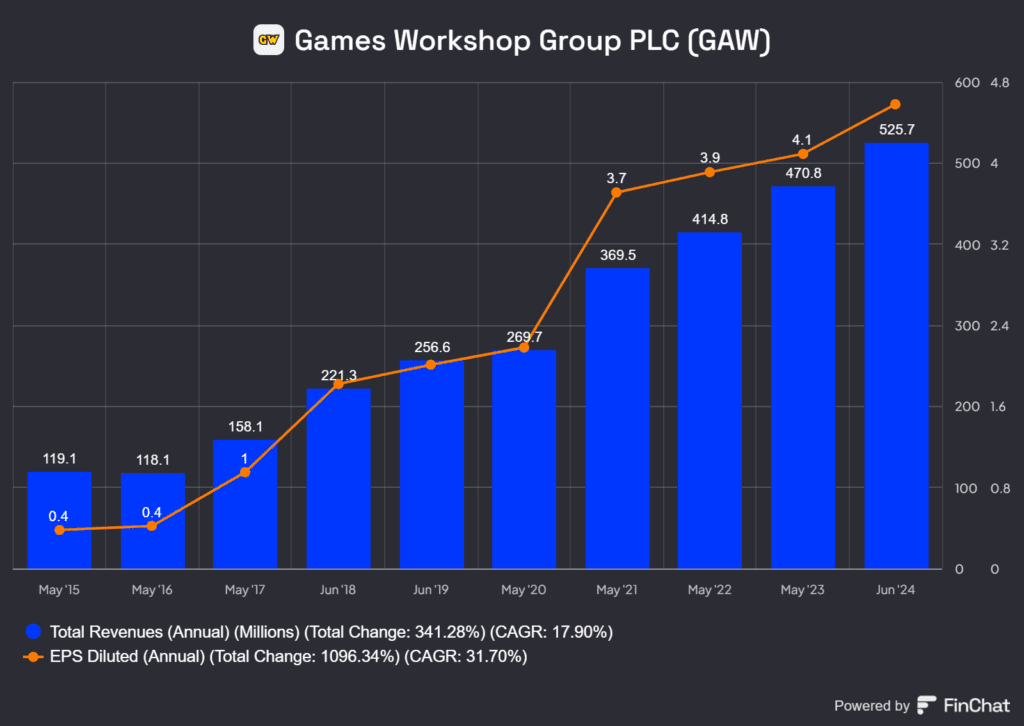

In terms of historical performance, Games Workshop have compounded revenues at around 18% a year for the past decade, with an impressive diluted per-share earnings CAGR of nearly 32%. This growth has slowed in the past five years, however both remain firmly in the mid to high teens.

Operating Cash Flows have compounded at over 26% a year for the past ten years, and because of relatively low capital expenditure requirements the business generates significant free cash flows. I’m particularly drawn to businesses such as these, where CapEx needs are low in relation to cash generated from operations. There’s an assurance gained knowing that barring a significant impact to business operations, ongoing investment needs to maintain and grow the business will safely be met. And of course, excess cash is then available to be utilised by management however they see fit.

The leadership team at Games Workshop currently opt to return excess cash to shareholders via dividend payments, which have compounded at nearly 37% a year for the past ten years:

Because of this dividend strategy, the share price of Games Workshop has increased by 2,122% over ten years, however the total return has been a far larger 3,668%. Long time holders have benefitted massively by this strategy. Opportunities for growth by acquisition may not be readily available, but opportunities to generate new and increasing sources of revenue, particularly recurring revenue, ensure that GAW can grow whilst still returning significant levels of cash to shareholders.

Lastly, from the perspective of financial sustainability and general quality of management, I wanted to make a quick reference the balance sheet. Games Workshop currently have enough current assets held in cash and investments to cover all liabilities, and there is zero long term debt. The largest proportion of long term liability is held in leases of retail stores.

Valuation

Previous readers will be aware that I tend to appraise businesses using a discounted cash flow assessment. This is used not to try to work out the specific intrinsic value of a business, but to ascertain the degree of margin of safety in a potential investment. So with this in mind, my discounted cash flow analysis of Games Workshop looks like the below:

Firstly, I need to define a discount rate to use in this analysis. Recently I’ve been using data provided from market-risk-premia.com to determine this figure, which uses a mixture of a risk-free rate and an implied equity/market risk premium to arrive at an implied market return. For the UK, the 10 year Gilt yield is determined as the risk-free rate, which currently stands at 4%. The website identify the UK market risk premium to be a shade over 5%, therefore the discount rate I’ll be using is 9% in this analysis.

On a per-share basis, the amount of free cash generated is £5.48 in the last full year results, so I’ll use this as the starting point. Assessing future growth is open to significant variance in interpretation, and generally I prefer to be cautious in my assumptions. In whatever time frame you choose, free cash flow has compounded at very healthy rates at Games Workshop, however that FCF growth is slowing. Annualised over 10 years, FCF grew at over 30%, but in the past three years has slowed to around 16%.

I’m confident in the growth prospects and opportunities for Games Workshop (particularly given their recent announcement of expansion plans to build a new factory in Nottingham), so I’ll assume this FCF slowing stabilises at 15% a year. The question then becomes “for how long can they grow FCF at this rate?”. The answer will determine the relative valuation of the business. Growth at 15% for five years would suggest the current share price is too high. Growth at 15% for ten years would suggest it is too low.

This is a well established business with a strong competitive advantage and runway to continue growth at reasonable levels. Combine this with low ongoing CapEx needs and I think it entirely possible free cash flow can grow at 15% a year for the next decade. To offset this, a conservative assumption following this ten years is a meagre 3% FCF terminal growth rate. With the free cash the business easily generates, 3% feels too low, but again I like to be cautious.

Conclusion

Putting this all together, I arrive at a current fair value for the business at £144 a share, compared to the current share price of £118. So does Games Workshop still look attractive at the current share price? I think it does. Is it trading dramatically below it’s fair value, offering a significant margin of safety? That’s a harder question to answer, and I’m inclined to say no. However, combine strong price appreciation, reasonable P/E and P/FCF valuations, and a current dividend yield of 4.5%, and you get something worth investigating further. I know I will be.

I’d love any feedback or comments on my interpretation of the business. Leave a comment below, or find me on X @X.com/britishinvestor or Bluesky @britishinvestor.bsky.social. If you enjoyed this post, please consider sharing it on the platforms above.

Happy investing!

Chriss

P.S. I’m a recent convert to Finchat.io, an A.I. assisted financial screening and share database that has significantly enhanced my ability to assess businesses and access data. Take a look via my referral link here.